While navigating potential economic uncertainties remains important, the region’s inherent strengths position it well for continued success in the commercial real estate (CRE) sector. As we progress through 2025, Wake County’s CRE market exhibits signs of stabilization and promising long-term growth, underpinned by robust population increases and ongoing economic development.

Office Sector:

The office market is experiencing stabilization, driven by a resurgence in tenant demand for in-person attendance. With a limited construction pipeline and no new starts anticipated in the near term, the availability of prime office space is expected to tighten. This scenario may prompt tenants to consider a broader range of properties to meet their needs.

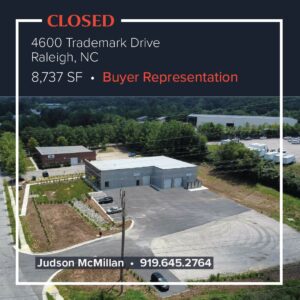

Industrial Sector:

The industrial sector continues to perform well. A slowdown in deliveries in 2024 is expected to lead to tighter vacancy rates in 2025. Strong demand for newly delivered industrial products is likely to encourage more developers to break ground on new projects, creating additional high-quality occupancy options. Wake County’s robust population growth will continue to fuel long-term demand for industrial space, driven by last-mile logistics and advanced manufacturing.

Medical Office and Retail Space:

The region’s favorable demographics are expected to sustain demand for medical office and retail spaces. The area’s appeal to new brands is likely to keep retail availability tight, with vacancies in high-demand locations being quickly filled. Additionally, the trend of developing live-work-play destinations is expanding beyond urban centers into smaller communities and traditionally suburban areas.

Life Sciences Real Estate:

The life sciences sector is anticipated to experience renewed demand as capital becomes more accessible. Significant investments by major biomanufacturers, including expansions by FUJIFILM Diosynth Biotechnologies and Amgen in Holly Springs, underscore the region’s status as a premier life sciences hub.

Generational Projects:

Several transformative projects are set to benefit all aspects of Wake County’s real estate market. These include the development of Dix Park, the Lenovo Center sports and entertainment district, the Raleigh Convention Center expansion accompanied by the new Omni Hotel, the RDU International Airport expansion, and RTP 3.0. The ongoing development of Hub RTP within Research Triangle Park, featuring new dining, office, and lab spaces, further contributes to the region’s dynamism.

Driving Factors for Continued Growth:

- Strong Population Growth: The continuous influx of new residents fuels demand across all CRE sectors.

- Economic Development Success: North Carolina’s recognition as a top state for business, coupled with significant job creation and capital investment in Wake County municipalities, fosters a conductive environment for business expansion and relocation.

- Infrastructure Improvements: Investments in transportation infrastructure, including the Bus Rapid Transit system and expansions at RDU International Airport and on major roadways like I-540 and I-440, enhance accessibility and attractiveness.

- Thriving Higher Education and Talent Pool: The presence of esteemed educational institutions like NC State University and Wake Tech Community College provides a robust talent pipeline, attracting businesses seeking skilled labor.

While challenges such as high interest rates and workforce shortages persist, the overall outlook for Wake County’s commercial real estate market in 2025 remains cautiously optimistic, buoyed by the region’s inherent strengths and strategic developments.