Looking Ahead: How Research Funding Cuts Could Impact the Triangle’s Commercial Real Estate Market

North Carolina’s Research Triangle has long been defined by the strength of its universities—institutions like Duke University and UNC-Chapel Hill that draw billions in federal research funding. This investment fuels not only academic discovery but also the region’s economy, workforce, and real estate development.

However, that symbiotic relationship is under pressure. Recent reductions—and the looming threat of further cuts—to federal research funding are beginning to reshape the landscape, with ripple effects across employment, innovation, and the commercial real estate (CRE) market.

A Strained Research Ecosystem

Universities in the Triangle are already feeling the impact. Since January, UNC-Chapel Hill has seen the termination of several federal grants, resulting in the loss of funding for the equivalent of 77 full-time employees. A mistakenly sent federal email revealed over 150 grant terminations, affecting institutions including UNC and Duke. Meanwhile, proposed changes to the indirect cost rates universities can recover from federal grants have heightened concerns. For example, capping these reimbursements at 15%—down from UNC’s negotiated rate of 55.5%—would significantly diminish the funds universities use to maintain research facilities.

In anticipation of these funding challenges, the UNC Board of Trustees has set aside $50 million to offset potential losses. Even so, total federal grant funding at UNC for fiscal year 2025 is already tracking below last year’s levels.

This uncertainty has already altered university planning. A prominent example: UNC-Chapel Hill paused its $228 million translational research building—a 174,000-square-foot project meant to attract top-tier talent and catalyze commercial innovation. The decision underscores a broader trend: fewer capital projects, delayed leases, and a general slowdown in research-related development.

Broader Impacts on CRE and the Regional Economy

-

Office, Lab, and Flex Space: Universities and their spinoffs are major tenants in these categories. As funding slows, so does the demand for new space—impacting vacancy rates and lease prices.

-

Startup Ecosystem: Life sciences and tech startups often emerge from university research. Cuts in funding may stifle this pipeline, dampening demand for coworking and incubator spaces.

-

Mixed-Use and Residential Development: With fewer research-related jobs and graduate students, demand for urban housing and mixed-use developments could also decline.

-

Investment Caution: The uncertainty may cool investor enthusiasm, leading to slower construction timelines and potential declines in property values, particularly near university campuses and RTP.

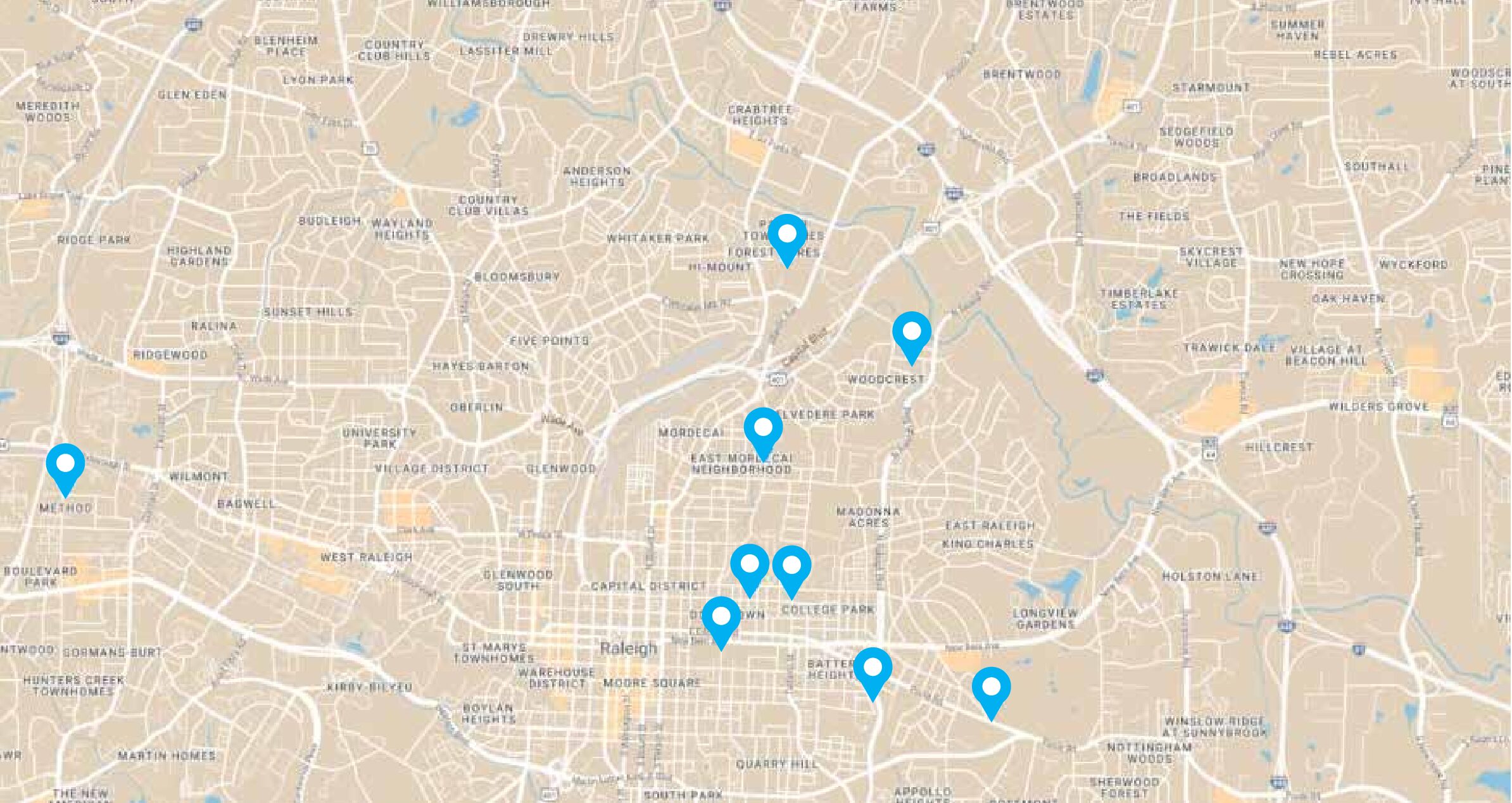

According to estimates, North Carolina could face an economic loss of $668 million from NIH funding cuts alone, with Durham, Orange, and Wake counties bearing the brunt.

Navigating the Road Ahead

While the full impact remains to be seen, the connection between federal research funding and real estate is clear. As universities adjust, CRE professionals will need to do the same—reassessing development strategies, monitoring public funding trends, and remaining flexible in how space is built and used. In a region where innovation has long been the engine of growth, staying attuned to these shifts will be key to future success.

Whether you’re navigating changes in the lab market, evaluating investment opportunities, or managing space near a university, our team is here to help you adapt with insight and confidence.

********

Sources:

Triangle Business Journal. (2025, May 29). UNC pauses $228M facility amid funding woes. [Subscriber content] https://www.bizjournals.com/triangle/news/2025/05/29/unc-pauses-translational-research-building-funding.html

WUNC. (2025, February 10). Trump order cuts research funding for NC universities, raising concerns about jobs and innovation. WUNC. https://www.wunc.org/education/2025-02-10/trump-nih-order-research-funding-nc-universities

Schenke, J. (2025, April 29). Universities put developments on ice as Trump cuts billions in research funding. Bisnow. https://www.bisnow.com/national/news/construction-development/college-headline-here-129169